NSG Group: Supporting an international glass manufacturer in transforming treasury operations and cash visibility across multiple subsidiaries

About NSG Group

NSG Group, known in the UK under the Pilkington brand, is one of the world’s largest manufacturers of glass and glazing products for the architectural, automotive, and technical glass sectors. Headquartered in Tokyo and operating in 30 countries, NSG sells to customers in over 100 markets, employs more than 25,000 people, and has a heritage of innovation and excellence dating back to 1918.

Andrea Feay, NSG’s Treasury Operations Manager and her team oversee treasury operations across the group, working with multiple divisions and over 100 subsidiaries.

The Challenge

Lack of cash visibility across group subsidiaries and international operation

n 2015, NSG’s treasury operations team was struggling under the weight of an outdated, decentralised cash management system. Each of NSG’s operational divisions and subsidiaries managed their own banking relationships and uploaded payment files through different online banking portals.

“There was a huge amount of manual effort involved and a complete lack of standardisation, so it was fairly sprawling and messy.” Andrea Feay.

Although NSG had already established a Shared Services Centre (SSC) in Poland to centralise finance operations, many processes were effectively ‘lifted and shifted’ with little in the way of harmonisation.

“The processes were pretty much copy-pasted. It was still local people doing things manually,” Andrea Feay.

The overall outcome was a patchwork of systems, formats, and processes that drained resources, created inefficiencies, and raised compliance concerns. It also resulted in group treasury having limited visibility of the company-wide cash position.

Subsidiaries uploaded reports every month via a consolidation system that was not only slow and unwieldy but also meant treasury only had a monthly figure on the group’s cash position, limiting strategic responsiveness.

In a bid to counter these issues, treasury had previously explored direct SWIFT connectivity for cross-border payments to become more bank agnostic and save time, but the high costs and technical barriers proved prohibitive.

“SWIFT was a great idea in theory, but for us, it was too expensive and too complex to manage internally.” Chris Davies.

The Solution

Phase 1: Treasury SWIFT Connectivity (2015–2016)

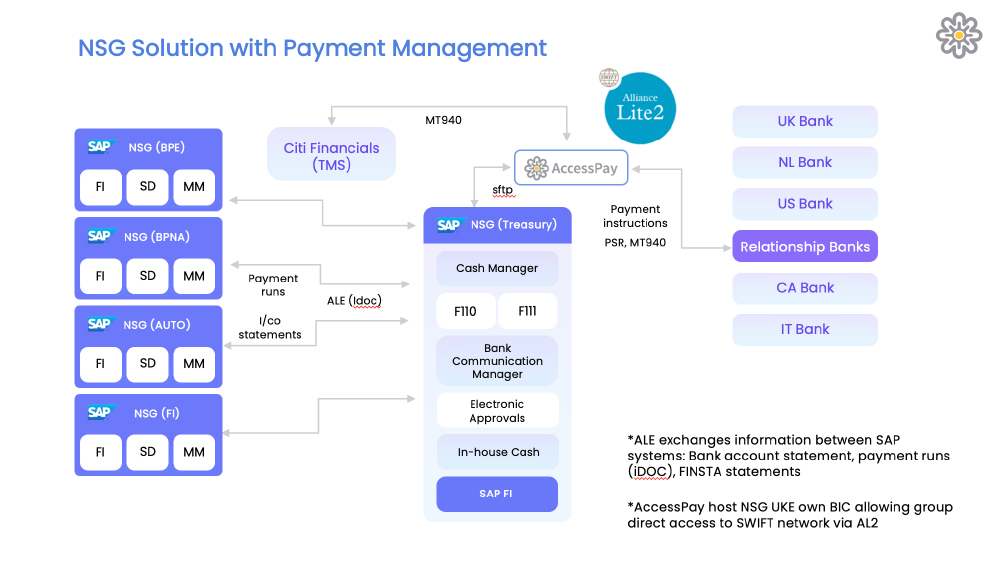

NSG’s treasury transformation journey began when it partnered with AccessPay to introduce SWIFT connectivity for high-value treasury payments. AccessPay was connected to NSG’s Treasury Management System, so all approved payments were released into AccessPay and then submitted to SWIFT.

AccessPay is file-agnostic, so it could accept payments in any format before converting them into the correct format for SWIFT.

This phase:

- Enabled NSG to automate payments and statement feeds for treasury accounts, removing the need to submit payment files and download statement data.

- Established real-time visibility across treasury bank accounts, thanks to centralised data in AccessPay.

- Improved security and controls by providing audit logs and eliminating the risk of manual manipulation.

Phase 2: Designing the payment factory (2016–2018)

Recognising the potential of AccessPay to improve bank connectivity and cash visibility across the group, NSG’s treasury team made the decision to build a payments factory.

It took the lead by engaging consultants and cross-functional stakeholders to design a scalable solution to accommodate future growth, with AccessPay providing guidance on SWIFT connectivity. To power the in-house bank model, NSG opted for SAP S/4HANA – a cloud-based ERP implementation. AccessPay then provided the integration layer that, via SWIFT, connected SAP to banks globally.

The pilot program

Launched in 2018, the pilot included three countries, 13 SAP company codes, and support for two currencies.

Services included:

- Payments on behalf of (POBO).

- Receipts on behalf of (ROBO), using virtual account structures.

- Collections on behalf of (COBO) for direct debits from customers.

- Automated MT940 statement reconciliation through three relationship banks.

A small Treasury Services team comprising only six members was established within the Polish SSC to support the rollout by taking responsibility for operations management and ensuring process consistency.

This phase:

- Increased payment automation across the group, saving time uploading payment files and downloading statement data.

- Reduced the number of bank accounts and the use of banking portals, saving both direct and indirect costs.

- Further enhanced centralised liquidity, enabling NSG to manage cash more effectively.

Phase 3: Expansion and optimisation (2019–2024+)

As the payment factory proved its value, NSG expanded the rollout across Europe, North America, and Canada. By 2024, the factory covered 17 countries and 48 subsidiaries, supporting ten currencies, nine outbound payment methods, two inbound payment methods, and over 300 affiliate accounts.

The solution also evolved to include new payment types, such as pin payments (PINO) and automated intercompany settlement functionality, replacing a labour-intensive monthly netting process.

This step further cemented the benefits achieved in earlier phases. It also:

- Reduced risk and improved controls, with direct connectivity between the ERP and banks removing the potential for manual manipulation.

- Expanded cloud-based access to systems, with an electronic paper trail of all activities.

- Facilitated expansion to new markets, with AccessPay providing access to multiple banks and payment formats.

The Results

The payment factory has delivered wide-reaching results for NSG Group. By transforming its treasury capabilities and simplifying operational processes, the organisation has cleared a path towards long-term, strategic growth.

Operational efficiency gains skyrocket

By 2024, NSG was processing hundreds of millions of Euros in payments through the factory, reaching tens of thousands of vendors. Meanwhile, automation continues to deliver thousands of hours in annual time savings through automated bank statement reconciliation and simplified payment processes.

Apart from some of these developments achieving payback in fewer than 12 months, the overall scale of NSG’s new efficiencies meant the group no longer needed to invest in constructing a second building at its Shared Services Centre in Poland. Instead, the existing team was able to take on more work with fewer people thanks to the automation delivered by the payment factory.

Automation and standardisation improve accuracy and job satisfaction

Introducing standardised processes across NSG’s subsidiaries dramatically improved accuracy, reliability, and governance. With the vast majority of customer receipts now cleared automatically, the risk of error has been slashed, and cash application has accelerated.

“Standardised processes mean people in the Shared Service Centre already know how the payment factory works. They can just pick it up and use it. It’s helped with cover for holidays, reduced training time, and improved controls.” Chris Davies.

Meanwhile, eliminating most manual tasks has freed employees to take on more meaningful tasks, boosting job satisfaction and helping create highly skilled positions within the SSC.

“At the start, people were stuck doing heavily manual, repetitive work. Now they’re in more value-added roles. That’s had a knock-on effect for job satisfaction and for the wider business.” Andrea Feay.

However, it wasn’t all plain sailing.

“There was considerable pushback from different areas where we were making changes. People were not particularly keen on the standardisation we were trying to implement. They had their own processes and their own ways of doing things, which they felt was the correct way. Yet, the people in the pilot phase – who were extremely resistant to change – are now our biggest cross-sellers across the group.”

A more agile and scalable payments infrastructure

Aside from the operational benefits, centralised management has drastically improved NSG’s ability to administer cash flow across the group. Cash pooling has enabled the treasury team to achieve substantial cost savings by reducing reliance on external financing, thus mitigating the impact of financial shocks.

In addition, the bank-agnostic architecture enables the group to easily shift between banking partners – a critical capability as financial relationships worldwide become more precarious.

The centralised platform, accessed via a single portal, supports multiple banks and jurisdictions, offering the flexibility to expand into new regions as needed. Because the system is cloud-based, it also enabled uninterrupted operations throughout the COVID-19 pandemic and continues to support hybrid and remote working.

Of equal significance, the success of the payment factory has laid the groundwork for future transformation. The standardisation and automation achieved in this project are now being replicated in broader accounts payable and accounts receivable initiatives across the business.

Key Lessons

For any company considering building a payments factor, NSG Group is well-placed to share the lessons learnt from its experience. Its message is simple: plan thoroughly, involve the right people early, and be prepared to persevere.

Getting the design right is essential

“Take plenty of time during the design phase. Get advice from peers and consultants. And involve your stakeholders — especially the ones who’ll be affected — as early as possible.” Andrea Feay.

Another critical success factor is engaging stakeholders early, particularly those whose day-to-day responsibilities will be affected. NSG found that involvement during the design phase improved the solution and helped overcome resistance to change through internal advocacy.

Above all, resilience matters, as implementing a payment factory is not without its challenges. However, by maintaining confidence in its chosen approach and the accompanying benefits helped the NSG team stay focused and united throughout.

“One of the key things we had to show during our implementation is resilience. But certainly, the benefits and the pride that you can take in such a big project is something I’ve really enjoyed.” Chris Davies.

The journey that began back in 2015 was long and winding, but NSG Group is now fully prepared and equipped for an exciting, digital-first future.

“In the end, the pride you feel from having delivered something that transforms the way your business works — it’s worth all of it.” Andrea.