"The ability to scale connectivity to multiple banks, jurisdictions and payment methods through a single standard connectivity process was a real benefit to us."

Automated Bank Feeds: Your path to efficiency, reduced risk and strategic insight

Automated Bank Statement Retrieval transforms financial data management by eliminating the labour-intensive process of manually retrieving, formatting, and uploading bank statements for greater efficiency, security and true cash visibility.

We are proud to work with

Consolidate multi-bank operations

for faster reconciliation

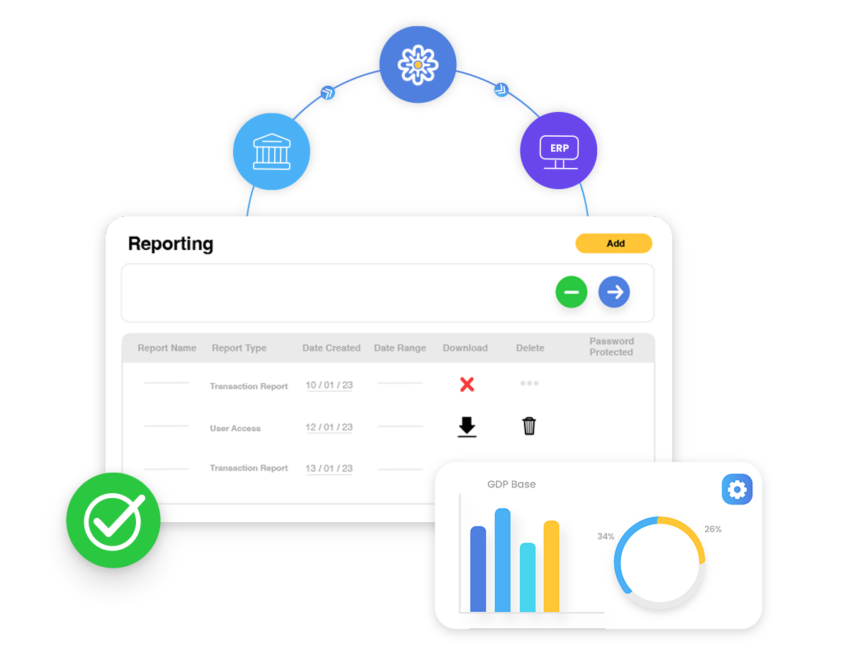

Connect your ERP, TMS and other back-office finance applications directly with your banks. Leveraging AccessPay’s data integration & transformation platform, collect and automatically transform your bank statements into a user-friendly format that your end-point finance applications can automatically digest.

Automated bank feeds remove the risks associated with manual intervention; supporting reconciliation, reporting and wider regulatory compliance, and ensuring you’re always audit-ready. Speed up your statement retrieval and reconciliation process to support strategic business decisions around your company’s cash position with accurate cash transaction data, even on an intra-daily basis.

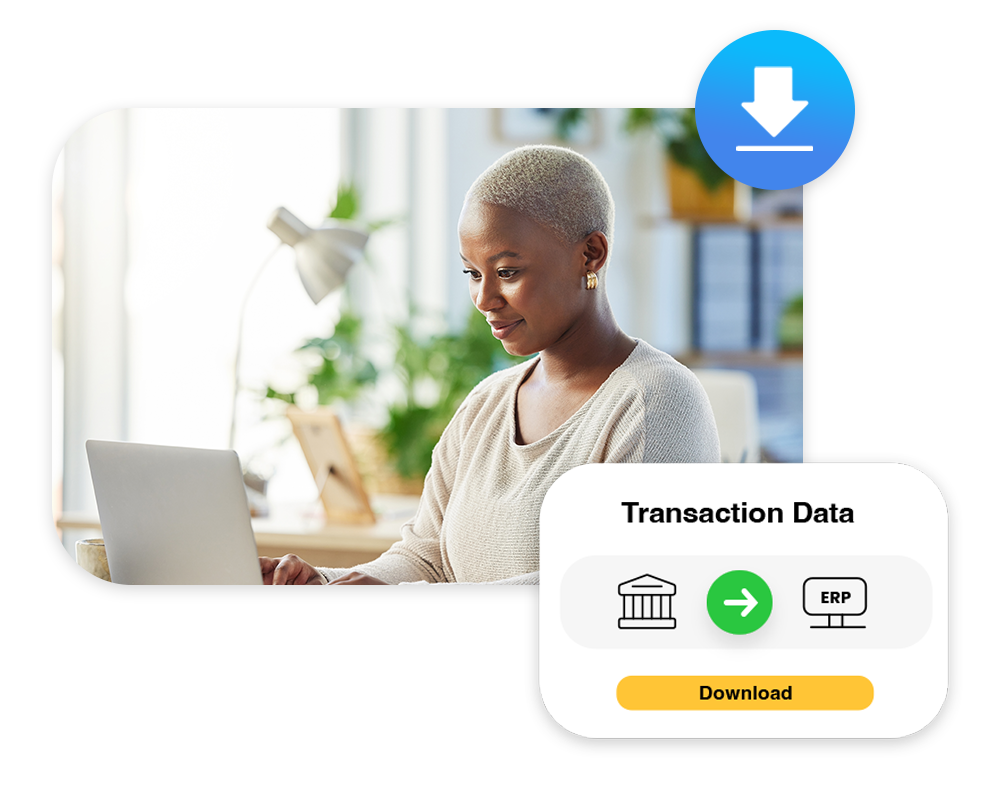

Save hours downloading and reconciling bank feeds

Guaranteed data accuracy

Mitigate the risks of manually accessing bank portals

Save hours downloading and reconciling bank feeds

Automating your bank feeds allows transaction data to be received from your banks on an intra-daily basis for a near-to real time view of your company’s finances.

Save significant time reconciling your bank feeds, even as your operations scale.

Only through robust bank connectivity can you take full advantage of the auto-reconciliation capabilities within your ERP/TMS and other financial close solutions; the middle layer between your back-office systems and your banks.

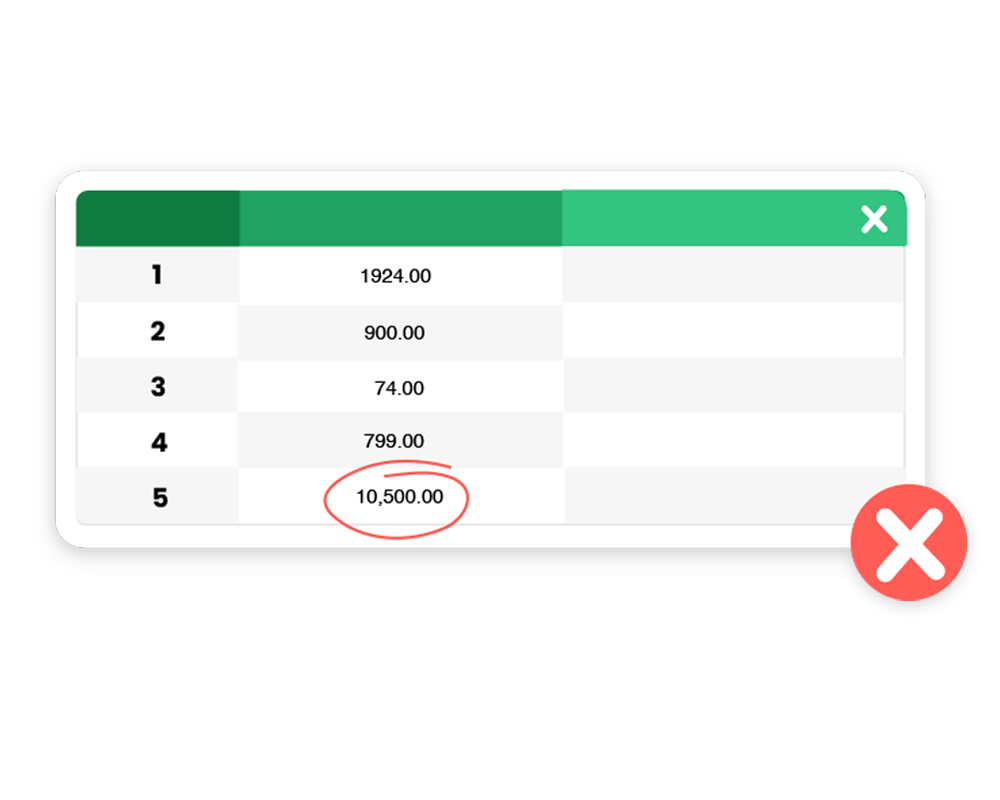

Guaranteed data accuracy

Errors in manual reconciliation can lead to strategic decisions being made from inaccurate data.

Automated bank feeds are the key to accurate financial decision-making. No more errors, formatting issues, and the costly redundancy of fixing data entry mistakes.

Save time and resources across your finance team so that you can focus on the bigger picture and make smarter decisions with your company’s cash.

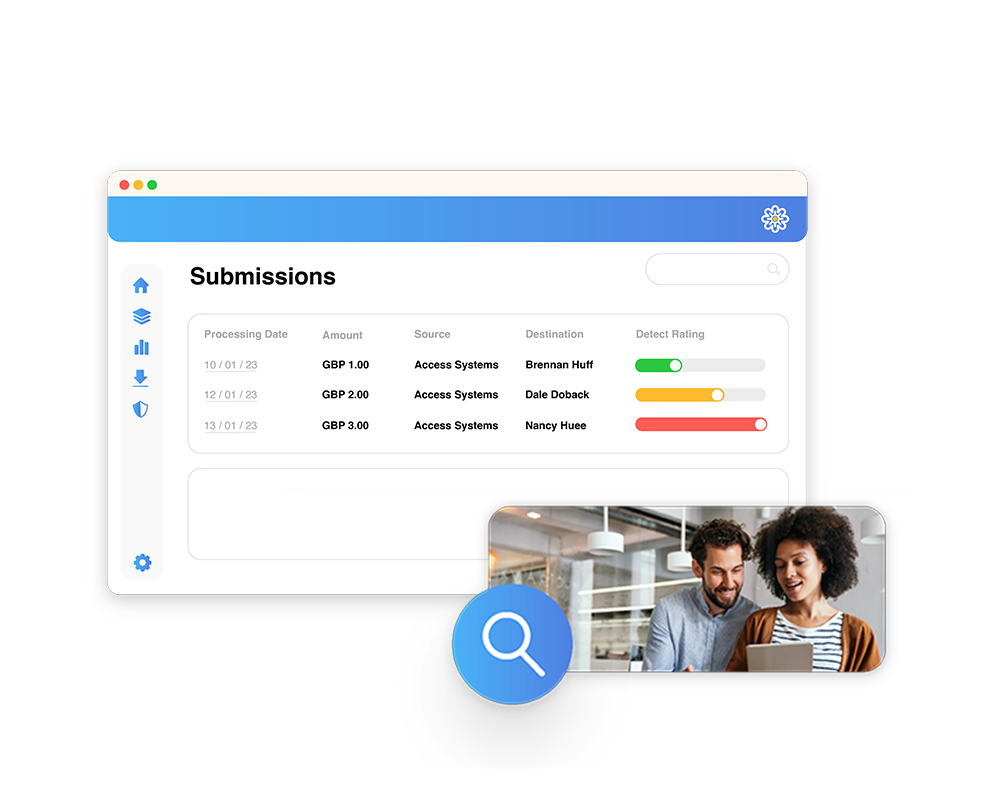

Mitigate the risks of manually accessing bank portals

AccessPay’s fully automated end-to-end solution minimises the number of high-risk users accessing your bank statements – significantly lowering the likelihood of data breaches and eliminating the possibility of fraudulent manipulation.

Automation also supports wider regulatory compliance, as manual processes are increasingly being flagged by compliance teams as a risk factor during internal audits.

Achieve auto-reconciliation:

Your key to strategic decision-making

CFOs need real-time cash visibility for a true picture of their finances, enabling crucial decision-making and ongoing financial management.

Bank statements are central to cash visibility and reporting, so it’s no wonder that enhancing reconciliation processes stands as a key objective for finance leaders. Through ERP-Bank integration, you can achieve auto-reconciliation with all major ERPs and back-office systems including NetSuite, Sage & Dynamics 365.

See how we can help you take the next step

to reduce risk and save your team

hours every week

Get in touch with one of our experts by completing our contact form

Streamlining banking operations

Benefit from enhanced financial efficiency with direct access to a vast network of leading banks.

Designed for multi-banked organisations

Access to 16,000+ banks

Timely, accurate reporting

"Without AccessPay, we’d have to revert to old manual processes, and we wouldn’t have the oversight of our cash we enjoy now. The platform has transformed the way we work for the better."

ERP-Bank integration:

Connectivity options

Using the SWIFT Network or AccessPay’s custom-built host-to-host connection, you can ensure streamlined bank statement processing and efficient communication with your banking partners.

SWIFT

Gain access to the SWIFT network via AccessPay’s BIC, allowing seamless bank statement delivery directly to your ERP. You’ll also be geared up for ISO 20022 changes coming into effect.

Host-to-Host

AccessPay constructs and upkeeps a tailored host-to-host bank link. This link enables direct receipt of bank statements via the AccessPay platform, transformed into a compatible format you ERP can consume.

Connect via API or sFTP

Choose between API or sFTP for secure data transfer. sFTP is ideal for periodic, large-scale exchanges, while APIs provide real-time access, integration, flexibility, and automation capabilities between applications.

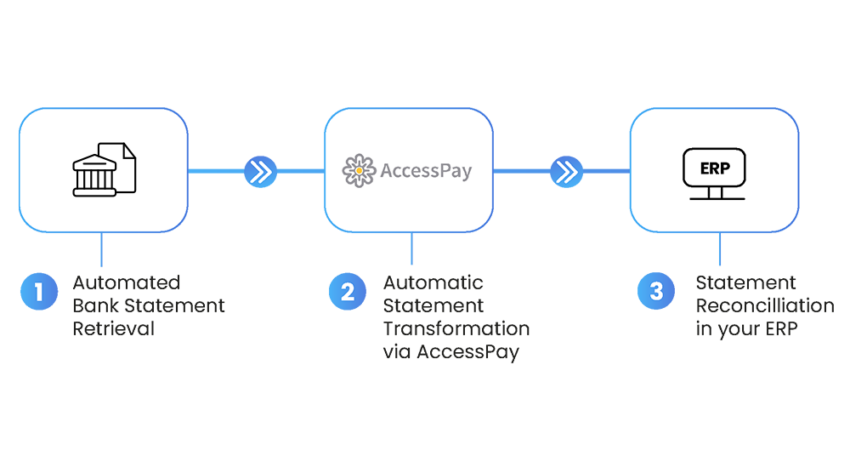

How it works

AccessPay is the connector between your back-office and your banking estate.

Utilising an API or sFTP connection, AccessPay pulls intra-day statement files from your connected banks and pushes them automatically to your back-office system, automatically transforming them into a format that’s consumable by your ERP, TMS or reconciliation tool.

Automating bank feeds: speeding up reconciliation and improving control

Understanding a company’s cash position is critical to all strategic decisions and effective, ongoing financial management.

Find out how automated bank feeds speed up the reconciliation process and ensure a faster close.

Fraud & Error Prevention Suite

Find out more about enhancing your payment controls and reducing risk with our fraud & error prevention suite.

"Our finance and treasury teams save 25 hours a week using AccessPay as a digital bank connection."

Ready to explore how AccessPay can help your business?

If you’re looking for support with your next bank integration project, you’ve come to the right place.

Complete the form to schedule a free consultation with one of our bank connectivity specialists.

Complete our contact form ➜