“Incorrect, or out-of-date information can lead to poor decision-making and sub-optimal business performance. If CFOs are to act as strategic advisors to the business, it is essential for them to have up-to-date accurate information to report back to the C-suite and board.”

Unlocking auto-reconciliation in your core back-office applications

With automated bank feeds, businesses can answer the fundamental question; “How much money does the company have?” with confidence and agility.

Utilise AccessPay’s ERP-bank integration to achieve full auto-reconciliation within NetSuite, Dynamics 365 & Sage; by automating retrieval of bank statement data for greater efficiency, data accuracy and reduced risk.

Get the most from your ERP, TMS

or Financial Close tools

Auto-reconciliation is possible within your back-office finance applications, but first, you need to establish bank integration. AccessPay acts as the middle layer between these applications and your banks, empowering auto-reconciliation.

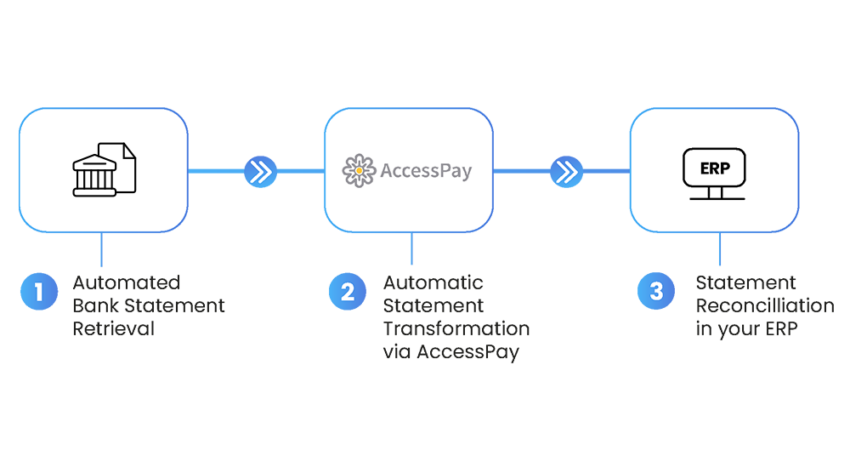

Leveraging ERP-bank integration by AccessPay, your statement data is automatically pulled from your bank, auto-formatted, and pushed directly to your back-office application.

How it works

AccessPay is the connector between your back-office and your banking estate.

Utilising an API or sFTP connection, AccessPay pulls intra-day statement files from your connected banks and pushes them automatically to your back-office system, automatically transforming them into a format that’s consumable by your ERP, TMS or reconciliation tool.

We are proud to work with

The benefits of the AccessPay platform

Achieve a faster financial close

Make strategic decisions with accurate data

Stay compliant and reduce the risks of fraud & error

Achieve a faster financial close

With ERP-bank integration, the reconciliation process can be fully automated both intra-daily and on end-of-day schedules, ensuring timely access to financial data – faster than ever before.

The opportunity for increased frequency of reconciliation means it can be performed more regularly whilst finance teams save significant time compared to doing this manually.

Finance teams can easily access transaction data from multiple bank accounts for a more streamlined and efficient reconciliation process.

Make strategic decisions with accurate data

For industries like Financial Services and the Legal sector, financial data richness is essential for accurate reporting.

And, in the investor landscape, a company’s revenues and financial position hinge on the speed of accounts completion, influencing investor judgment.

ERP-bank integration assures data accuracy, consistency, and the timely exchange of financial data to empower organisations with the tools they need to make well-informed, strategic decisions, trusting their company’s statement data is accurate and up-to-date.

Mitigate the risks of manually accessing bank portals

Manually accessing bank portals can increase the risk of data breaches due to the potential for fraud via data manipulation.

Human error can also result in inaccurate financial reporting, posing compliance threats for regulated organisations who require rich data to stay compliant.

ERP-bank integration ensures your bank statement retrieval process can be fully automated, reducing the number of high-risk users managing your accounts. It also standardises payment controls and eliminates the possibility of fraudulent data manipulation, safeguarding sensitive systems and ensuring regulatory compliance.

“Without AccessPay, we’d have to revert to old manual processes, and we wouldn’t have the oversight of our cash we enjoy now. The platform has transformed the way we work for the better.“

We work with most leading ERP and smaller

back-office applications. Speak to our team today to see how we can help you implement auto-reconciliation to improve efficiency, reduce risk and support strategic decisions.

Get in touch with one of our experts by completing our contact form.

Watch our short demo to see how AccessPay integrates with NetSuite

The same process applies to all ERPs and other back-office applications including Sage and Dynamics 365.

Find out how AccessPay integrates with your core back-office applications and ensure a faster close.

Peerless connectivity options

Designed for multi-banked organisations

Boost efficiency by increasing match rates to 60% or higher

Access to 16,000+ banks globally

Access the SWIFT network for quick bank statement delivery

Choose from host-to-host or API connections

Compliance with ISO20022 standards

“How much cash does the company have right now? It’s a fundamental question, but without automated bank feeds, it’s one where the answer becomes dated very quickly.“

Why choose Bank Integration over Open Banking?

Richer data & insights

AccessPay delivers richer statement data, supporting ISO20022 (CAMT.52, CAMT.53) and bank formats (MT940, MT942), BAI format. Allowing for more detailed insights into your financial data.

Full bank coverage

Full bank coverage

AccessPay’s bank coverage is global. We support SWIFT member banks and non-member banks to provide a seamless experience no matter which banks you use.

No re-authentication required

Unlike Open Banking solutions, AccessPay’s secure service does not require re-authentication every 90 days, which reduces the administrative headache for organisations managing accounts with multiple banks.

Optimise your reconciliation process

If you’re looking for a way to automate your bank feeds for full auto-reconciliation, our bank statement retrieval service will help you achieve this.

Speak to one of our team today to find out how you can get the most from your back-office applications to drive greater efficiency and reduce risk across your banking operations by integrating with AccessPay.

Speak to our team ➜