Chris Allison

Project Manager, Admiral

We spoke with our bank, and they recommended AccessPay as the preferred solution. We also spoke with other insurance providers, and everybody recommended you, which is highly commendable.

Uncovering the hidden risks of manual processes for business banking, and how to modernise your finance operations.

Whilst manual banking processes are seen as “free to use” the true cost to your business will probably shock you.

of businesses surveyed in our Drive to Digital 2022 Report are still using bank portals to make payments and retrieve statements.

had a turnover of at least £100m and most were global organisations.

Online banking has multiple levels of security that make it safe and convenient to use, with the sole reason for its secure nature being the fact that only the user has access to their personal account.

Sharing access to banking portals with multiple people across the finance team is not an ideal solution because bank portals are not equipped to manage finances securely across multiple users.

Giving your employees access to your company’s bank portal has become the norm, but as technology moves on, it should no longer be acceptable.

In order to mitigate risk across your finance operations, removing the reliance on bank portals is the crucial first step.

Why? Because by using bank portals, you’re giving one individual total control over your company’s financial data. With little to no control over their actions, and the inability to successfully audit when and who is making payments, businesses are struggling to stay complaint with regulatory measures.

There is also an increased risk of error, fraud or theft, and you’re leaving these processes open to greater malicious activities such as hacking, identity theft and phishing.

For corporates, bank portals are the wrong use case. Here’s why:

Inefficient

InefficientManually logging in and making payments is time intensive and a tedious manual task for a finance professional.

Lack of control

Lack of controlIncreased risk of fraudulent activity with little to no control over who is making a payment, or the accuracy of a payment.

Chance of human-error

Chance of human-errorIncreased risk of mistakes and inaccurate payments through the manual entry of data.

Incompatible payment files

Incompatible payment filesBack-office systems often produce payment files that are not compatible with bank portals which can be resource heavy & time intensive for the finance team.

Manual reporting

Manual reportingReporting on payment statuses and statement retrieval data can take hours to process, involves complex spreadsheets, and is error prone.

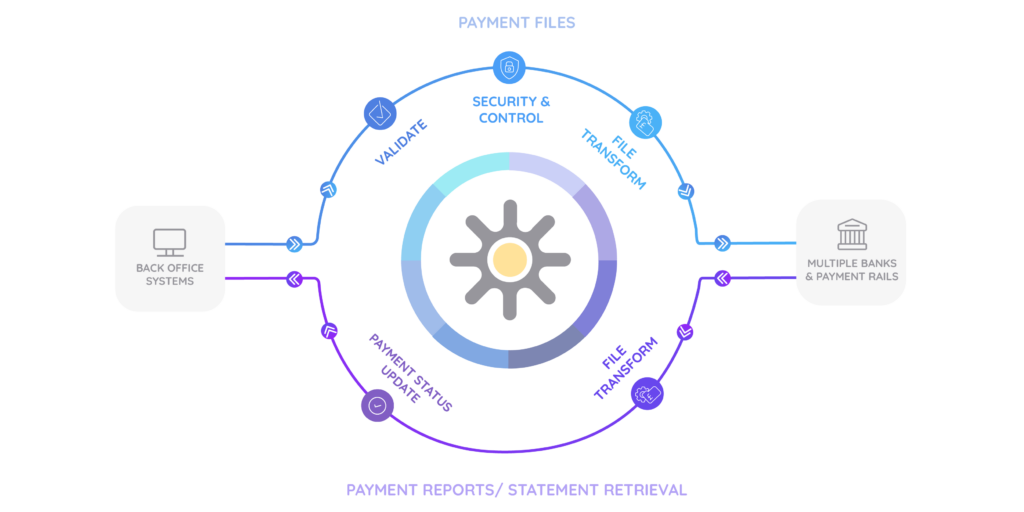

Banks offer a range of different connections which can replace the use of banking portals by connecting your back-office directly to your primary bank accounts. Not only does a direct connection remove the need for manually processing but helps keep transaction costs low.

Depending on the type of payments you make, there’s a bank connectivity option that will work for you.

You can connect via a traditional SFTP (Secure File Transfer Protocol) connection, or a new API connection which offers a fully embedded experience. Both methods are a viable alternative to banking portals, however the APIs are considered to be the future.

They can be fully configured by the corporate client to integrate directly with compatible back-office applications, or managed through a 3rd party connectivity provider like us.

We eliminate the complexity of a bank connectivity. Our managed bank connectivity solutions can connect all your back-end systems to your banks and payments rails, all through a single system. Plus, have relationships with banks across the globe – so you can benefit from our pre-existing connections to ensure seamless implementation of your project.

Project Manager, Admiral

We spoke with our bank, and they recommended AccessPay as the preferred solution. We also spoke with other insurance providers, and everybody recommended you, which is highly commendable.

Treasury Risk Manager, NSG

AccessPay is secure which is a big advantage to the group as it reduces the opportunity for fraud and any operational error in inputting files correctly.

Treasury Manager, Willmott Dixon

The thing that keeps me up at night as a Treasury Manager is fraud – both internal and external.

Process all payment types through one platform

Automate Collections through your Direct Debit Management System via Bacs and SEPA

Standardise internal payment controls to reduce the risk of fraud and error

Improve cash visibility with daily or intra-daily statement retrieval capabilities

The file transformation engine means you’re compliant with new messaging formats (such as IS020022 xml)